Francesco Venturini, CSPs, and the Brain Gain

With over 20 years of experience in the telecommunications consulting sector, Francesco Venturini has an undeniably unique understanding of the direction the industry is headed - and a uniquely interesting plan of action to match.

We spoke to Venturini recently as part of our feature exploring how the telecom sector can fight for a bigger slice of the ROI from their 5G rollouts, compared to the industry’s experience following the launch of 4G.

4G has completely reshaped day to day life, and allowed the companies behind their commercialisation (like Netflix, Uber and Spotify) to rake in billions of dollars every year.

However, the telecommunication and digital infrastructure companies responsible for the infrastructure underpinning 4G - and the massive capital expenditure required to make the technology a fact of daily life - didn’t end up seeing a return on investment (ROI) proportionate to their expenses. In fact, as OTT streamers and other digitally disruptive firms continued to grow exponentially off the back of the increased bandwidth and connectivity being funded by communications service providers (CSPs), those same CSPs found themselves increasingly boxed into a discrete, growthless segment of the market.

Venturini, a Senior Managing Director at Accenture, has lately found himself focusing on helping telecom operators to monetise their network assets and avoid the same outcomes that the industry saw following the 4G rollout. To pull this off, he’s become a vocal component of an approach he calls The Connected Brain.

What is the Connected Brain Gain?

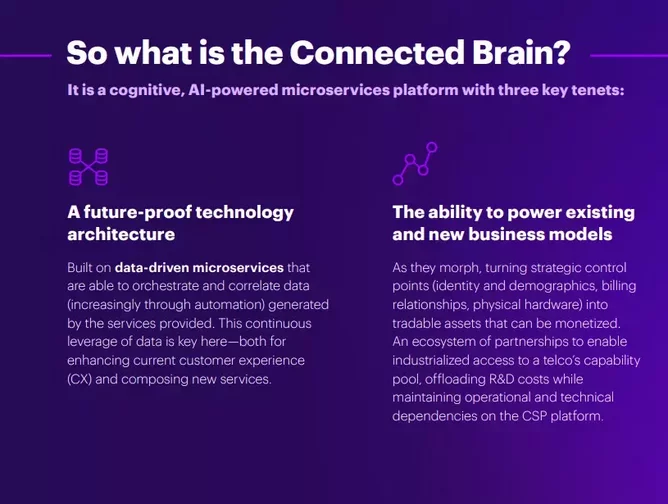

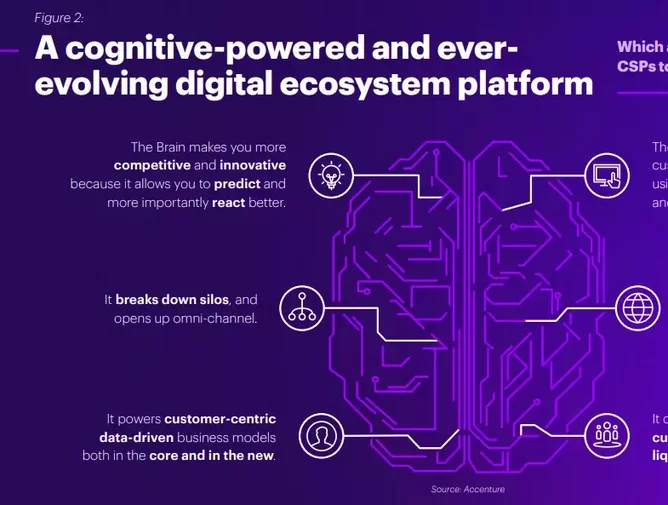

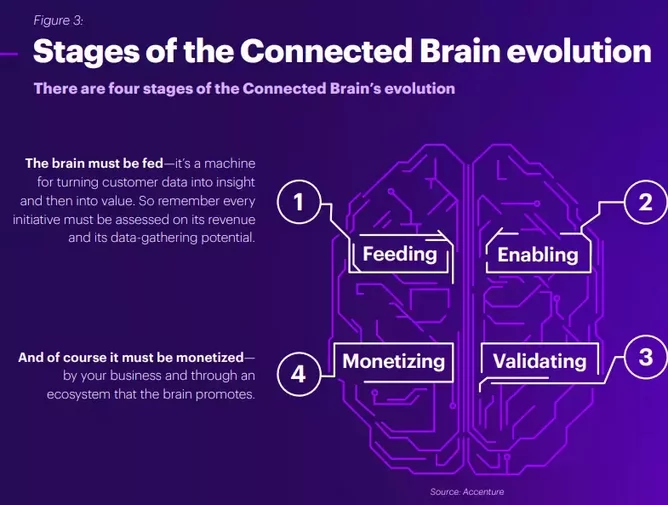

The connected brain approach is a cognitive, AI-powered microservices platform with three key tenets: future-proof technology architecture, the ability to power new and existing business models, and a fundamental shift at the operational level.

“With the Connected Brain, CSPs can fulfil their promise of a connected consumer platform or an x-industry orchestrator for businesses, leaving their commoditised legacy connectivity business behind in favour of a vast new landscape of significant revenue potential—and a promising, growth-oriented future,” Venturini explains.

In his report on the Brain Gain, Venturini notes that Most, if not all telecommunications companies have felt the effects of commoditisation as well as the looming threat of the more nimble, digital disruptor. Despite the havoc caused by the pandemic, the post-COVID world has opened up a window of opportunity for CPSs directly tied to connecting and monetising value chains in an era of edge computing and platform ecosystems.

“But the time to act is short. The time to move is now,” Venturini writes.